Tactical Fund Management | White Rock Capital Management

Investment Management Alliance For RIA's and AdvisorsGrow Your ria firm

Learn more about our alliance Services

For optimal risk/return metrics

The Tactical Advantage

Proprietary Platform

Mitigate risk and protect from downturns in the stock market.

Pro-Active

Continuous balancing of the potential for excess return against the commensurate risk involved.

Transparent & Repeatable

Rooted in a rules-based process — a step-by-step qualification criteria.

The Tactical Alliance Advantage

RIA Solution for

Growth & Management

Build stronger client relationships based on improved financial portfolio performance.

Blended portfolio

The Tactical Difference

We Actively Manage Growth Objectives and Risk.

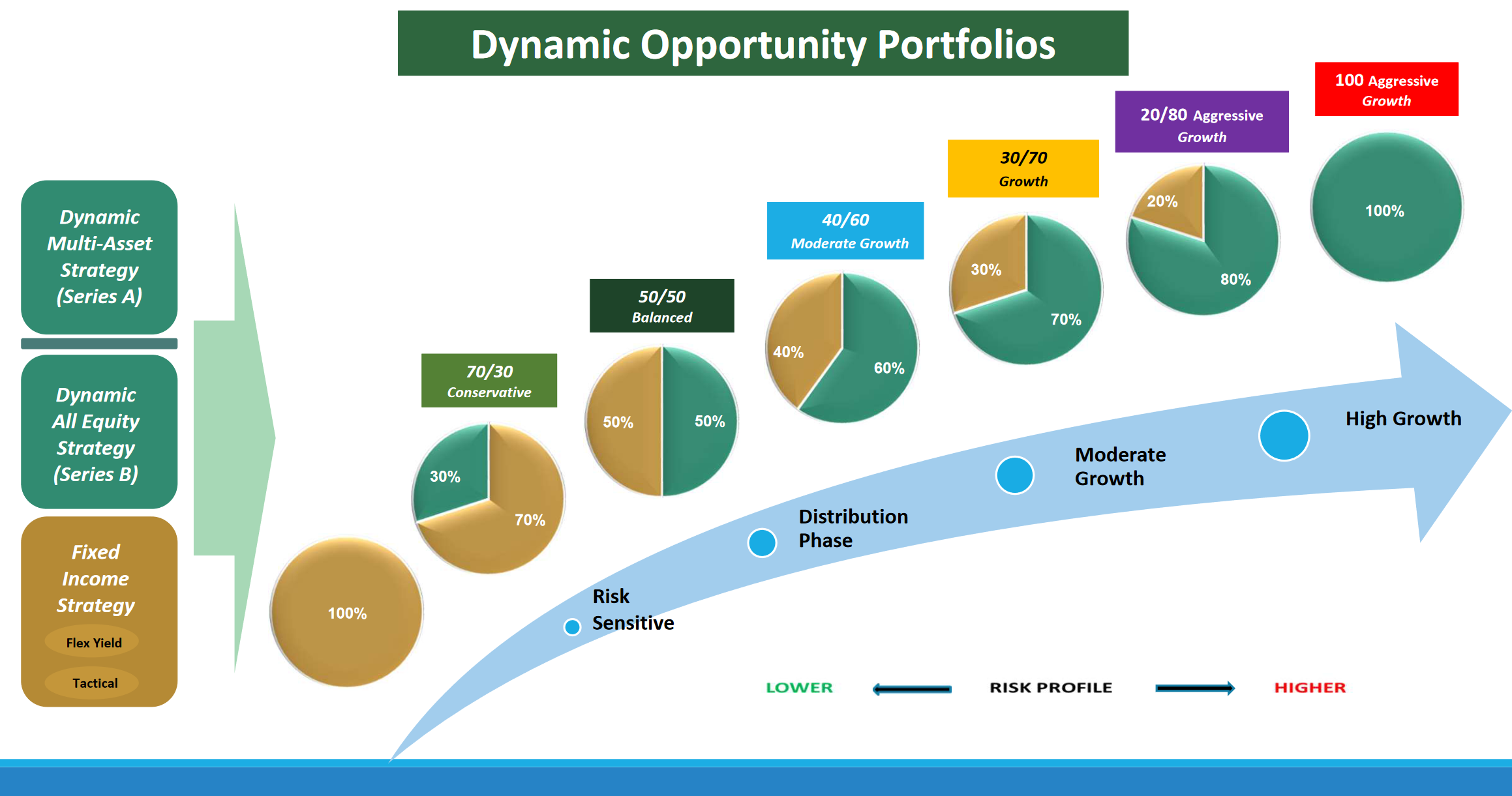

Our Customized Blended Portfolios combine up to three (3) tactical strategies (momentum and risk parity) into one algorithm that respond to markets with the objective of simultaneously maximizing long term growth potential while minimizing risk.

Dynamic Multi-Asset Strategy

Dynamic Multi-Asset Strategy: An adaptive allocation model designed with a focus on what we consider to be the top stocks in the Nasdaq 100 and the S&P 500. In addition, we’ve added equity index ETF’s and a layer of diversification consisting of multi-asset class ETF’s, which include commodities and precious metal positions that are not correlated to the equity markets.

Dynamic All Equity Strategy

Dynamic All Equity Strategy: An all-equity portfolio comprised of top NDX/SPX stocks by market capitalization utilizing a relative strength tactical model focusing on momentum leaders.

Tactical Fixed Income Allocation

Tactical Fixed Income Allocation: An actively managed fixed income portfolio using tactical asset allocation seeking to increase alpha and reduce volatility by rotating efficiently in and out of asset classes as macro, technical or fundamental trends change

Tailored Strategies to Meet Your Clients Needs

Blended Portfolio Strategies

Contact Us

White Rock Capital Management

8880 Cal Center Drive

Suite. 195

Sacramento, CA 95826

____

Office 916-706-1234

Fax: 888-363-2937