Blended Portfolio component

Tactical Fixed Income PortfolioEstablishing reliable fixed income solutions

Intro

Actively Managed Fixed Income Portfolio

In 2020, coordinated central bank efforts played a major role in stabilizing and improving the trajectory of fixed income markets. However, their unorthodox policy responses have severely distorted the fixed income markets, amplifying the decades-long trend of lower sequential returns to create a current income conundrum with generation-defining ramifications.

It’s no longer prudent to sit passively in the fixed income sector and expect stable, reliable income anymore. So, we’ve created an actively managed solution.

The Tactical Fixed Income Strategy is a component of the Blended Portfolio and is not available as a stand-alone portfolio strategy.

strategy

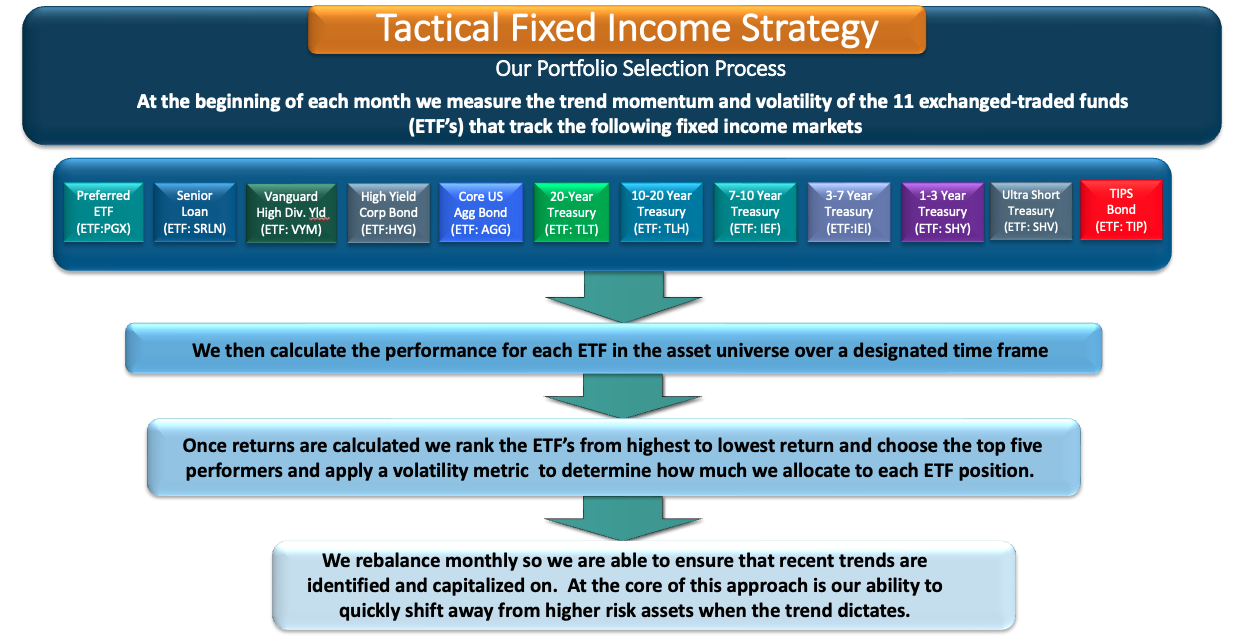

Componenets of the Tactical Fixed Income Strategy

- An actively managed fixed income portfolio using tactical asset allocation seeking to increase alpha and reduce volatility by rotating efficiently in and out of asset classes as macro, technical or fundamental trends change.

- The model uses a similar strategy as our Absolute Return model, with a 5-month timing window and a 3-month volatility measurement.

- The portfolio will hold the top five performing ETF’s out of a universe of 11.

- The strategy is rebalanced monthly.

Contact Us

White Rock Capital Management

8880 Cal Center Drive

Suite. 195

Sacramento, CA 95826

____

Office 916-706-1234

Fax: 888-363-2937