Blended Portfolio component

Adaptive Asset AllocationSuccessful Investing is managing risk effectively

Intro

Rebalancing Risk to Maintain Long-Term Growth

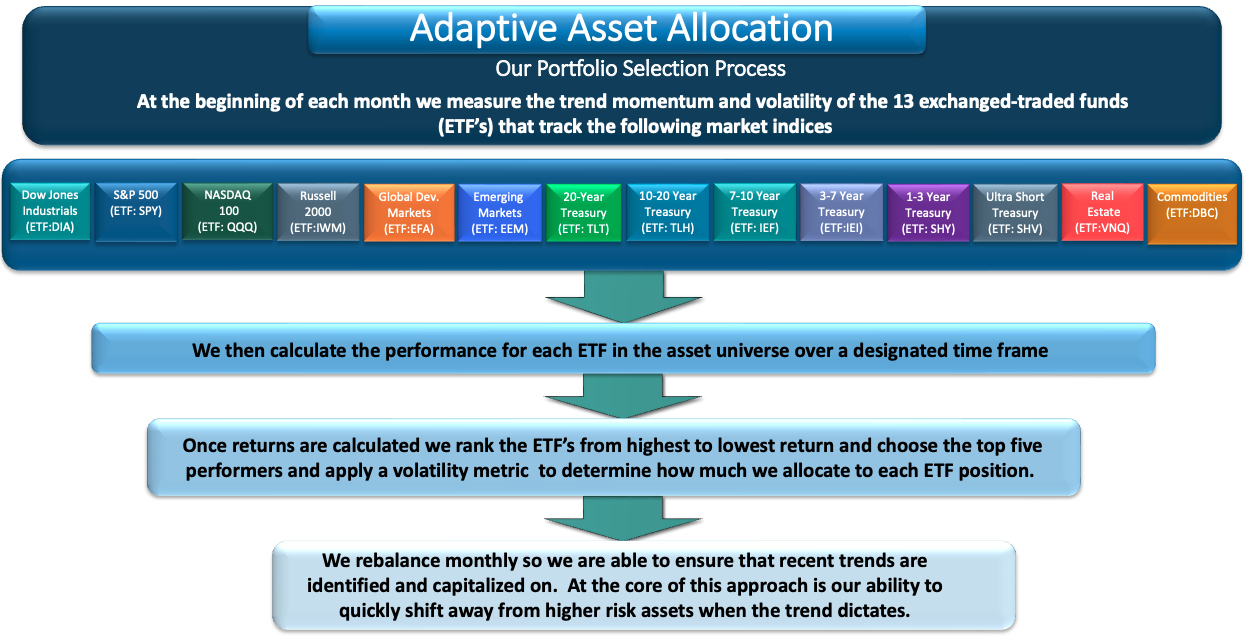

At its core, our adaptive asset allocation methodology is simple: we take an actively managed approach by rebalancing more frequently than traditional asset allocation models to better align the portfolio with current market trends. Our investment model is structured to participate in a wide variety of asset classes and is enabled to quickly and continually respond to changes in asset class risks and relationships.

By combining two different tactical approaches (momentum and risk parity) into one algorithm, our model builds a portfolio that responds quickly to market conditions with the objective of simultaneously maximizing return while minimizing risk. Portfolio is rebalanced monthly.

The Adaptive Asset Allocation Strategy is a component of the Blended Portfolio and is not available as a stand-alone portfolio strategy.

Strategy

Taking A Top Down, Macro Approach to Investing

Our effective strategy is designed to follow the trends of the markets to mitigate risk exposure to weak asset classes and seek asset classes that are exhibiting near term momentum.

Our model builds a portfolio that responds to market conditions with the objective of simultaneously maximizing return while minimizing risk.

Contact Us

White Rock Capital Management

2271 Lava Ridge Ct.

Suite. 200

Sacramento, CA 95826

____

Office 916-345-3555

Fax: 888-363-2937