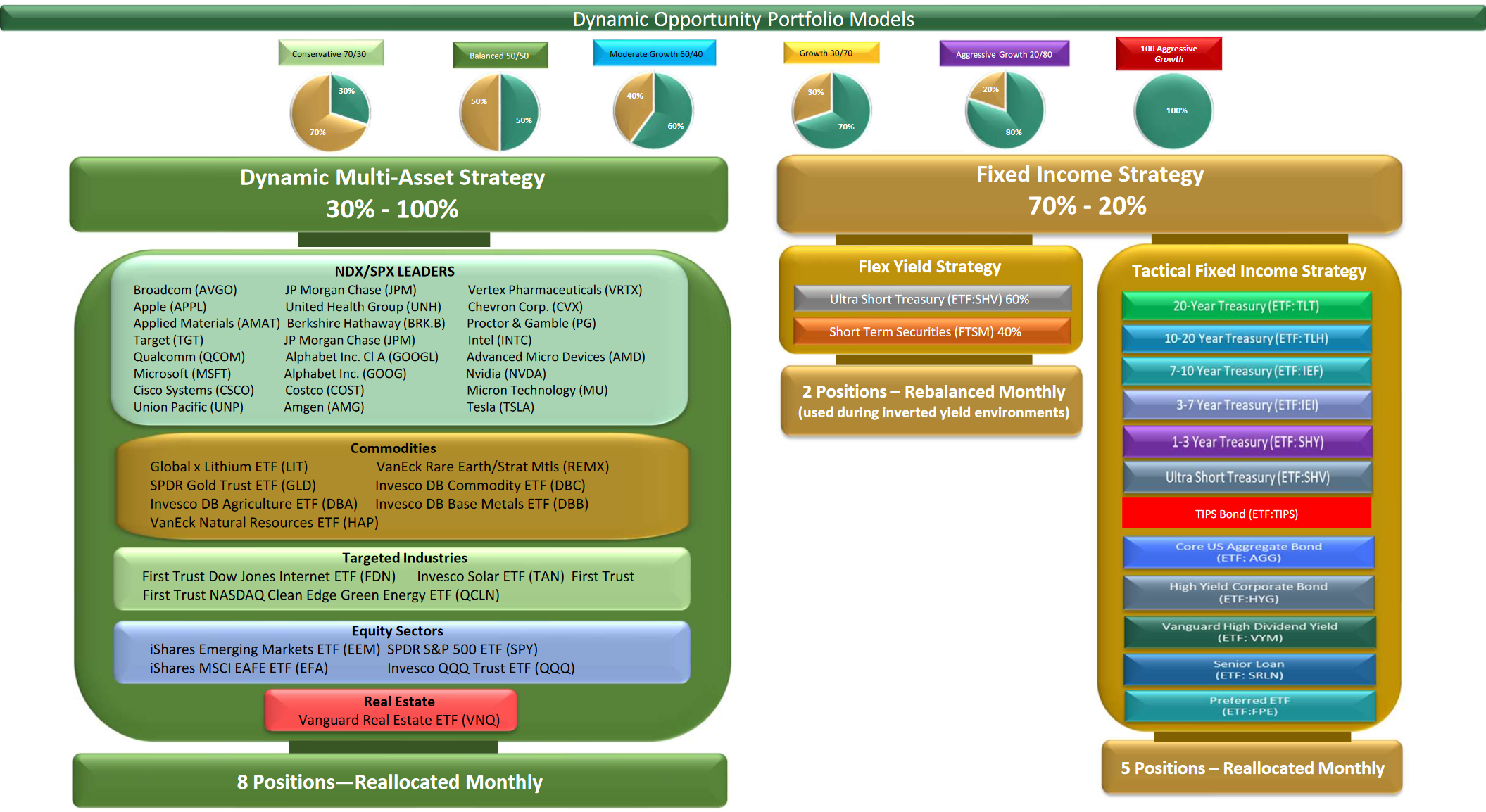

Blended Portfolio component

Dynamic Multi-Asset StrategyThe New Generation Portfolio

Intro

Weighted Positions Based on Momentum and Volatility.

The Dynamic Multi-Asset Strategy – Series A is an adaptive allocation model designed with a focus on what we consider to be the top stocks in the Nasdaq 100 and the S&P 500. In addition, we’ve added equity index ETF’s and a layer of diversification consisting of multi-asset class ETF’s, which include commodities and precious metal positions that are not correlated to the equity markets. We run these through a proprietary tactical allocation screener each month to determine the top eight candidates for investment. We want to balance out the risk amongst the portfolio, so allocation weights vary according to each investment’s risk profile.

The portfolio consists of:

- 10 Stocks in the top 20 stocks in the NDX 100 by market weight

- 10 Stocks in the top 20 stocks in the S&P 500 by market weight

- 24 Multi-Asset ETF’s, fixed income, commodities

The New Generation Strategy is a component of the Blended Portfolio and is not available as a stand-alone portfolio strategy.

strategy

New Generation Multi-Asset Strategy

The Dynamic All Equity Strategy – Series B is an all-equity portfolio comprised of top NDX/SPX stocks by market capitalization. The model is a relative strength tactical model focuses on momentum leaders and selects from some of the most actively traded issues. Each month we select 8 candidates for an equally weighted investment portfolio and replace and reweight issues accordingly.

Contact Us

White Rock Capital Management

2271 Lava Ridge Ct.

Suite. 200

Sacramento, CA 95826

____

Office 916-345-3555

Fax: 888-363-2937